Consumers will give lenders simpler accessibility bank recommendations

«Let’s say i did having mortgage loans exactly what the Internet did having to order sounds and you will plane tickets and you can footwear?» One provocative opener so you’re able to Quicken’s Very Dish post to possess Rocket Mortgage sparked controversy over if or not a different houses drama happens to be merely a beneficial click out. Although advertising only markets another technology that allows people to originate mortgages more efficiently. Indeed, a number of parts of the fresh app you certainly will reduce the dangers inside lending making it easier for people with sub-standard credit locate a home loan.

Merchandising financing originators now originate simply thirty-five money each month opposed having 185 into the 2001, with respect to the Home loan Bankers Relationship

In spite of the posh name, this new Rocket Financial isnt an alternate mortgage means; it’s just a tool to help you better assemble suggestions for programs. That have Rocket Financial, the latest borrower authorizes Quicken in order to directly supply financial statements and you will income tax efficiency. Put differently, they entirely automates a previously labor extreme processes. The lender no further must be sure he’s precisely published the brand new pay stub pointers into the automated underwriting system. They not need certainly to be sure it made use of the correct money installment loan Texas to help you calculate your debt-to-earnings ratio. Its neither an automible to expand the credit box neither something new you to definitely signals the new renewal of your risky techniques of the middle-2000s.

Approvals might be less likely to produce peoples error. Prior to the overall economy, loan providers competed exactly how little advice they could collect regarding an excellent borrower. Zero money, no assets, no problem try the newest motto. New services, which invited getting straight down monthly payments proliferated. By comparison, that it tool immediately gathers all of the shred of information that’s needed to evaluate a great borrower’s capacity to repay, for the intended purpose of making a traditional home loan-most likely a thirty-season fixed rate financial. What’s significant towards Rocket Home loan is not that one to will get approval in the eight minutes, however, that automating the procedure can help be sure compliance and reduce threats. Like this, this really is the fresh anti-drama product.

Automation may simplicity rigorous credit. We have made the idea many time your borrowing from the bank box would be large. Additionally, i’ve revealed one tool exposure, maybe not debtor exposure, powered the newest casing drama, and market is now taking less than half the chance it absolutely was ingesting 2001, a period of intellectual financing conditions. It means borrowing is simply too rigid now for borrowers which have quicker than just primary credit. Why? Partially due to the fact lenders fear whenever they make possibly the littlest non-substantive mistake regarding financing files, they’ll certainly be forced to buy right back that loan immediately following its sold in order to a trader.

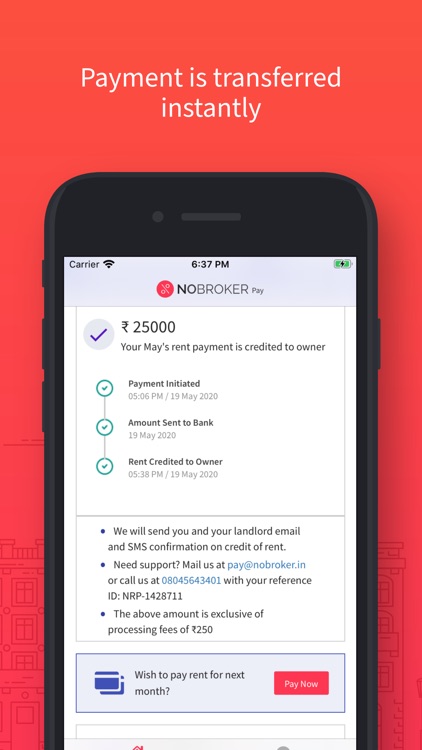

One to obviates the need for the newest debtor to collect and you may publish from inside the shell out stubs, lender statements, and fill in the form providing lenders entry to tax returns

A automatic procedure that allows loan providers to with ease verify conformity that have various legislation will reduce lender stress that will slow down the overlays which might be keeping borrowing from the bank so rigorous. If the automated gadgets for example Skyrocket Mortgage let lenders lend towards full the quantity of the credit box, it could be a hugely self-confident benefit.

Digital credit will be here to stay. Skyrocket Home loan is not necessarily the just tech pioneer in the financial application space: Technologies are swinging in the such as a sudden rate you to definitely Housing Cord recently began identifying brand new 100 most when you look at the winners for the February 1. But over 250 nominations had been registered with the 2015 competition. Earlier champions provides integrated Blend, a great technology guiding new wave from mortgage lending and you may Roostify known as accelerating and you may streamlining your house financing and you may closure experience. Guaranteedrate expenses itself as the brand new earth’s very first electronic mortgage.

Deja una respuesta