Current Page: What it Setting, The way it operates

Matt Webber are an experienced individual financing creator, researcher, and you will publisher. They have wrote extensively toward private financing, purchases, together with effect away from tech on modern arts and you will community.

What is actually a gift Page?

Something special page is actually a bit of courtroom, composed correspondence clearly proclaiming that currency acquired regarding a pal or cousin is something special. The best access to provide characters is when a borrower has already established guidance to make a down payment into a different sort of family and other real-estate. Including emails believe that the bucks acquired isnt anticipated to be distributed back into any way, figure, or setting. When you have acquired something special regarding family relations otherwise family in order to buy assets, the mortgage supplier might need that signal something special letter.

Within publication, we’re going to have a look at just what a gift letter try, exactly how and exactly why you can utilize one, and you will just what income tax implications away from merchandise is actually.

Trick Takeaways

- A present page was a piece of court, authored interaction stating that money acquired out-of a friend or relative is a gift.

- Gift letters are essential in terms of purchasing a real property advance payment, such as for instance, because lenders usually frown through to borrowers having fun with even more borrowed currency to possess a down payment with the a property or any other property.

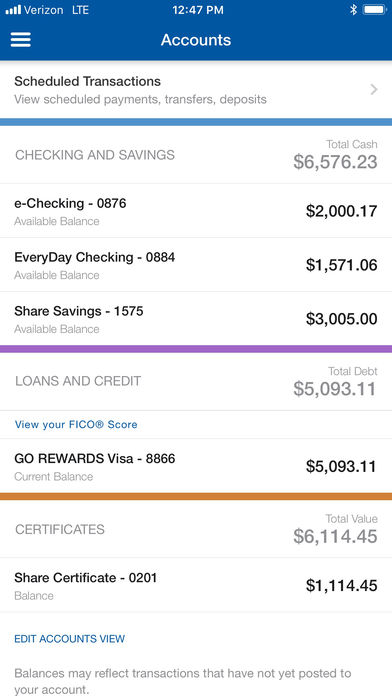

- A lender need an acknowledgment having a present letter in the event that you will find abnormally higher dumps to your bank account top right up with the purchase of a property otherwise a sign of third-class finance permitting finance the purchase.

- A present page need hold the donor’s term, this new gift’s really worth, verification your provide isnt are paid down, additionally the donor’s trademark.

- Getting income tax 12 months 2024, the yearly different on a present for every single individual per year are $18,000, an increase regarding $1,000 more 2023, depending on the Irs (IRS). A donor would need to pay fees and you may installment loans in North Carolina file a present tax go back into the people matter above you to definitely count.

Prominent Purposes for Provide Emails

A present letter are a proper file exhibiting those funds your have obtained is actually a gift, not a loan, hence the brand new donor has no criterion about how to pay the cash straight back.

A gift shall be broadly defined to incorporate a sale, change, or any other import away from possessions from just one person (this new donor) to another (new individual)mon types of merchandise are:

- Bucks, examine, and other concrete points

- Going a subject to help you stocks otherwise property versus researching one thing in return

- Forgiving loans

- Below-business financing

If you find yourself current characters try most common which have mortgage down payments, they’re provided for house believed objectives or that have good gift out-of collateral. A guarantee current letter accompanies a property deals lower than market value. So it usually is when someone gift ideas property so you’re able to a relative.

Present Emails and Mortgages

Regardless of if gift characters can also be defense any type of provide, made for any goal, he or she is most frequently used into the process of trying to get home financing buying assets. If you are to find property, of course you really have gotten a financial current which you bundle to use into the a home loan down payment or settlement costs, then you certainly ought to provide a gift letter to prove that the money is not that loan.

During the underwriting procedure to possess a mortgage, loan providers will get evaluate a loan applicant’s economy and you may verify that he’s got this new methods to pay-off the borrowed funds. Additionally, that it more debt could be considered whenever factoring about pricing and terms of the mortgage contract.

Such as for instance, imagine you only had partnered along with your grandparents provided your $5,000 while the a marriage gift. You can use that it currency into the an advance payment and you may closure will cost you toward a property, however, to do this, you are going to need to guarantees your own financial seller this was not an effective loan.

Deja una respuesta