The new Homeowners Guide to Financing Their Prefab Domestic in the North park Ca

Information Prefab Belongings

Prefab homes, small getting prefabricated house, are property that will be are available off-website after which transferred on their last location to end up being make. Such land are produced in managed factory surroundings, which could make them faster to create than conventional belongings. Prefab homes ranges in vogue of progressive to help you traditional and you will are tailored to suit the fresh homeowner’s preferencesmon form of prefab homes is standard property, are created homes, and smaller residential property. Prefab homes can be Solitary Family members Residential property , Connection Dwelling Tools or Multiple-Nearest and dearest Home. A separate program MHAdvantage aka CrossMods House supply the property owner the purchase price savings regarding prefab property however, qualifies for the appraised appreciated off web site dependent house.

Advantages of Prefab Homes

Prefab home are generally way more rates-productive than just traditional belongings considering the streamlined build techniques. Likewise, they may be energy-efficient, that produce down bills over time. Prefab land is personalized, making it possible for homeowners to help you personalize their living area considering the choices. Also, they are environmentally friendly, while they write shorter waste through the structure compared to the old-fashioned land. More over, prefab home are faster to create, so that you can be relocate sooner or later and start enjoying the brand new home quicker.

Resource Choices for Prefab Land

In terms of capital prefab property, there are numerous available options to consider. Typically the most popular an easy way to funds a good prefab house in Ca were old-fashioned mortgage loans, unsecured loans, and you can framework money targeted at prefab house. Conventional mortgage loans work well to own prefab property one meet basic building rules. Signature loans bring immediate access in order to finance just in case you may maybe not qualify for conventional mortgages. Framework loans specifically made to own prefab land bring financial support for both your house as well as set-up.

Finance and you may Financial Considerations

When investment your own prefab home into the Ca, thought additional financing options. FHA financing try well-known to have first-go out home buyers, requiring the absolute minimum down payment out of step three.5%. Virtual assistant fund promote benefits to pros and you may effective-obligations army group, and additionally zero down payment. Traditional money was another option, normally requiring an advance payment with a minimum of 20%. Look some other home loan costs and you can mortgage terms and conditions for the best fit for the money you owe.

Bodies Direction Software

Government guidance programs for the Ca helps you fund their prefab home. These programs seek to create home-control more accessible and you may sensible to possess Californians. A number of the regulators guidelines alternatives include advance payment direction apps, first-day home visitors apps, and you may low-desire mortgage applications. These types of software also have financing and you may bonuses for these lookin to order a great prefab domestic.

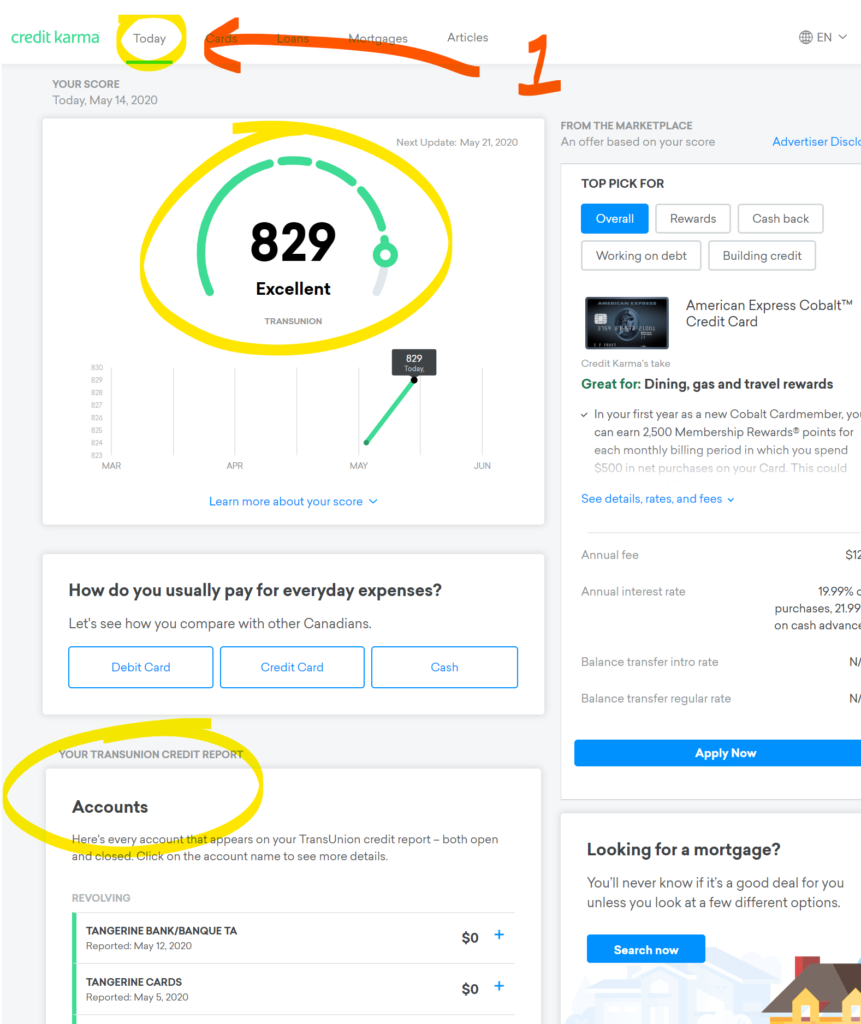

Credit score and you will Economic Preparing

Keeping a good loans in Celebration credit score is key whenever funding a great prefab house. Lenders use your credit history to choose their creditworthiness and interest rate your be eligible for. A high credit history often means down interest levels, saving you cash in tomorrow. Before you apply for a financial loan, review your credit history for mistakes and you will manage improving your get if needed. Begin by expenses costs on time, staying mastercard balance low, and you can to prevent beginning the newest borrowing from the bank accounts. Monetary preparing involves preserving to have a down payment, wisdom your budget, and you can assessing your general economic fitness.

Cost management getting a beneficial Prefab Domestic

When cost management getting a beneficial prefab home into the Ca, it is vital to envision individuals will cost you for instance the actual costs of the prefab home, one homes costs, beginning and you may installation charges, basis will set you back, permits, energy connectivity, and you may any additional adjustment you could add. To ensure you stay inside funds, it is recommended discover estimates from multiple prefab home companies, cause for any potential upgrades otherwise customization’s, and you will very carefully comment the fresh small print the invisible costs otherwise charge that may happen. Considered and you may evaluating very carefully allows you to perform a sensible finances to suit your prefab domestic investment and give a wide berth to one financial unexpected situations collectively how.

Selecting Loan providers and you may Mortgage Testing

While looking for lenders to finance their prefab domestic, begin by evaluating regional credit unions, banking companies, an internet-based lenders you to concentrate on home loans. It’s required to evaluate rates, loan words, and you may charge away from some other lenders for the best package. Evaluate these information when comparing funds:

- Rates: Look for a reduced rates offered to spend less more than living of your own mortgage.

- Mortgage Terminology: Pay attention to the duration of the mortgage and you can if this has the benefit of independency inside fees alternatives.

- Fees: Consider people origination charges, settlement costs, or prepayment punishment that could increase the cost of the new mortgage.

Of the evaluating lenders and you may financing choices, you possibly can make an informed decision that meets debt needs and helps you secure investment for the prefab household when you look at the California.

Legal aspects and you can Contracts

While speaing frankly about legalities and you may agreements to suit your prefab home within the California, there are many secret things to bear in mind. Make sure you thoroughly comprehend and you may see all of the agreements before you sign all of them. Look for legal counsel if needed to be certain you’re safe. Here are a couple away from facts to consider:

- Ca keeps specific guidelines governing prefab land, therefore learn such rules.

- Understand the warranty info provided by producer and creator so you can end one surprises later.

Methods for Effectively Funding Your own Prefab House

Whenever capital the prefab home, it is important to care for a good credit score. Loan providers have a tendency to look at the credit score to choose your loan eligibility. Prioritize saving to have a down-payment so you’re able to safer a more favorable mortgage terms and conditions. Shop around for loan providers examine rates of interest and financing possibilities. Think delivering pre-acknowledged for a financial loan to show providers you are a significant customer. Engage with a representative having experience in prefab house to greatly help navigate the fresh to get process smoothly.

Deja una respuesta