??Profit-and-loss Report Mortgage Program – Unlocking Home loan Approval to have a multitude of Advertisers

?Have you been worry about-functioning? And also become refused to own a home loan simply because they you failed to tell you sufficient money in your tax returns?

But, this new unfortunate fact is a large number of financial institutions routinely refute lenders so you’re able to really well better-licensed people, simply because of your own tax returns. If you find yourself sick and tired of this, and looking having an answer, search no further.

Self-operating home owners, rejoice! Is that loan system that’s going to fix this issue for you. Its named money & Losings Statement Mortgage. (aka P&L Mortgage, Profit-and-loss Mortgage, Profit-and-loss Statement Mortgage, P&L Mortgage)

That is The ideal Candidate Having A profit And you will Losings Report Mortgage?

This loan program is ideal for business owners, independent contractors, or small business owners who have trouble qualifying for a traditional mortgage loan. It can also be helpful for applicants who may be having a difficult time qualif??ying for non-traditional loan programs like Bank Report Funds or a 1099 Earnings Program.

- Listed below are some examples of individuals who can make use of so it program:

- Bucks companies

- Firms that features unusual otherwise inconsistent dumps

- Seasonal income

- Money which comes away from several higher deposits a year. (such as for instance possessions buyers or flippers)

- Business owners who have been in operation for at least 2 decades, Or… are in team for around one year which have at the very least couple of years away from functions knowledge of an identical community since your online business.

The way the Funds & Losses Statement Loan System Really works

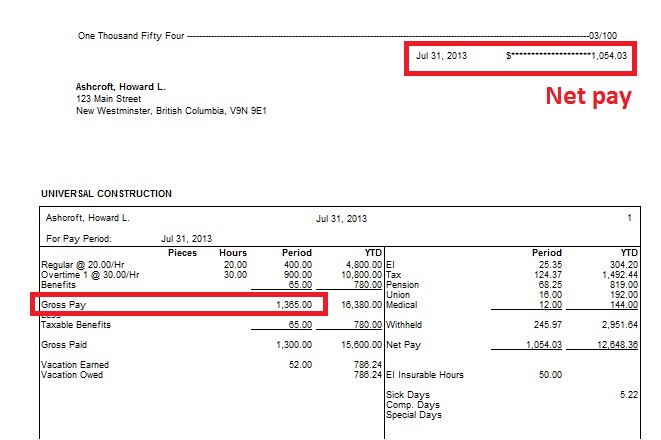

For the a classic home mortgage, the lender asks for countless anything, also tax statements (company and personal), support W2’s, 1099’s, paystubs. but when you will be thinking-working or if you will be another specialist, even more required, such as for instance per year-to-day profit-and-loss statement, harmony sheet, and frequently other economic comments.

The newest Profit-and-loss Declaration Financing System functions differently. This might be a home loan that works well nearly such all the other conventional Financing you really have came across, With the exception of one to trick differences: Unlike utilizing the earnings shown on the Tax returns— you merely give us income and you may Losings Report waiting of the one licensed taxation preparer for previous 2 yrs. Brand new Earnings & Losses Report mortgage does not require any tax returns.

After we grab the disgusting earnings minus expenses, we count the online profit (just after expenditures) using this declaration, and you may separate because of the a couple of years, additionally the resulting figure gets the monthly Income that individuals fool around with to help you meet the requirements the new application for the loan.

Sure, truly that simple—and we find this method provides a much better notion of your correct providers money compared to the brand new taxation go back method old-fashioned home loan.

Provides And you will Benefits of A return And you will Losses Report Financing System

- 31 Year Fixed Rates Terms and conditions

- 31 12 months Repaired Rates Terms and conditions

Simple tips to Be eligible for A profit https://paydayloanalabama.com/benton/ And Losses Report Loan

Self-A job Records – So you can be considered, you ought to possibly A great) enter organization for at least 24 months Otherwise…B) you should be in operation for around one year that have about a two year functions knowledge of a comparable industry since your providers.

While you are worry about-employed and you can you’ve got which much in business, it don’t occurs while the you will be used to delivering NO to have a response—very avoid enabling these types of big banking companies and borrowing unions show No, once we have significantly more reasons to say Yes.

Check out our Profit and Loss Statement Loan Program Page, or if you have a question you can simply Drop Us A line Here.

Derek Bissen are an authorized Mortgage Originator with over twenty-five numerous years of knowledge of the industry. Derek was a self-working credit pro that is recognized for their power to work that have consumers who possess reasonable money and you will non-antique lending means. He could be an innovative financing structurer and specializes in profile credit, asset-founded credit, lender report financing, including traditional fund such as for example Old-fashioned, FHA, Va, and you will very first-day homebuyers.

Derek’s knowledge of the mortgage marketplace is unparalleled. He or she is a dependable advisor to help you their members, providing them with tailored financing possibilities one to meet their particular monetary goals and requirements. His vast knowledge and experience make your a valuable asset in order to individuals looking to buy a house or re-finance their existing home loan.

Just like the a highly-educated financing creator and you can author, Derek are dedicated to sharing their studies with others. He on a regular basis brings valuable expertise and you will advice in order to members seeking to navigate the fresh cutting-edge realm of mortgage financing. His content articles are academic, enjoyable, and you may supported by years of give-for the sense.

Along with his insightful knowledge and commitment to his clients, they are the fresh wade-so you’re able to origin for your entire mortgage credit need. If you are searching having a reliable and trustworthy home loan pro, get in touch with Derek today to find out more about just how he can help you achieve your financial specifications.

Deja una respuesta