An Introduction to Price Action Trading Strategies

You could be the type of trader who needs to add more confirmation into your trading. You may also want to filter out bad price action or help with finding trends. One way to accomplish this is by combining indicators. We have different risk tolerance levels and we have different favorite markets. Two simple ways to find trend trades using price action are trendlines and moving averages.

Trading doesn’t work this way and the price is a very dynamic concept. Price and patterns change all the time and if everyone is trying to trade the same way on the same patterns, the big players will use that to their advantage. The screenshot below shows how the left head-and-shoulders pattern occurred right at a long-term resistance level on the right. Point 4 on the right chart marks where the head-and-shoulders forms. Zooming in and out on your chart can often help to see the bigger picture better and enable you pick up important clues.

- Compare to the moving average trader who just entered the trade, you’ve already exited the trade to book your profits.

- It’s not an indicator in the traditional sense.

- By the end, you will have a better understanding of how to leverage price action to improve your trading results.

However, prior to that event, there are data that can indicate that ECB will be cutting its rate like CPI, PPI, PMI etc. That means that market priced in the event prior to the decision based on the economic data that precedes the interest rate decision. I love the price action strategy but I don’t know how to trade it. I burnt accounts trading news and found your price action post as a great reminder and.should rank first. You’ve learned what is price action trading and the difference it can make to your trading. This means if you rely on indicators for your entries, you’ll be slower compared to someone who trades based on price action.

Further Rayner….please make a article on the role of big players and the effect on retail traders with examples from currency pairs….Thanks…. I think I would rather go by your price action idea. I now i have come to the realistion that price action is the king. Hello Ray, kindly show me how to place this S/R, at what time frame, the value of SL and TP, how long you can move your TP of the trend continues.

#14: Do You Make These Support and Resistance Mistakes?

The Club Foot Print indicator is very clear and easy to use. Each video tutorial is taught by experienced traders and is designed to be easy to understand and follow. A comprehensive understanding of this trading strategy, including its key concepts, tools, and techniques. Self-confessed Forex Geek spending my days researching and testing everything forex related.

We’ve also put together a short video to help with some of the advanced concepts we discuss. Please have a watch as a primer for the content below. It’s clear that every single one of the pin bars lacks follow through and secrets of price action trading instead of a reversal, the price keeps grinding higher. In this section, we will delve into these advanced candlestick patterns and explore how they can be used for precise entries and exits in your trading strategy.

Price Action Discounts Everything

Interestingly, every break of a trend line is preceded by a change in the highs and lows first and a break of a more objective horizontal breakout. When the price breaks a trend line during an upward trend, we can often notice how the trend has already formed lower highs. This is one of those price action secrets that can make a huge difference and we have seen that many of our students have turned their trading completely around with it. During an upward trend, long rising trend waves that are not interrupted by correction waves show that buyers have the majority. On the other hand, smaller trend waves or slowing trend waves show that a trend is not strong or is losing its strength.

Some indicators are just statistics, the ATR is a measure of relative volatility, it is always correct, but how you use it takes skill and understanding, just like any other tool. It is the design and back/forward testing of the algorithm that makes the difference between blind algo usage and empirical algo trading. Hi Rayner,

I too agree that https://g-markets.net/ Price is king and nothing will beat price action trading but the habits die hard though. If you can overcome that you will be consistently a profitable trader of-course. By relying solely on price, you will learn to recognize winning chart patterns. The key is to identify which setups work and to commit yourself to memorizing these setups.

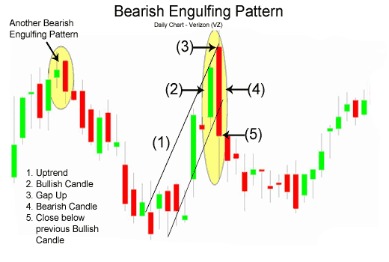

Candlestick pattern analysis

With this in mind, in lieu of a technical indicator, one helpful tool you can use is time. To that point, if you can trade each of these swings successfully, you get the same effect of landing that home run trade without all the risk and headache. Notice how NIO over a 2-week period experienced many swings. While this is a 5-minute view of NIO, you’ll see the same relationship of price on any time frame.

- I share my knowledge with you for free to help you learn more about the crazy world of forex trading!

- One way to do this is by using a trailing stop-loss order, which adjusts the stop-loss level as the price moves in the trader’s favor.

- One of the best ways to create your own price action trading system is to combine different strategies until you find what suits your trading personality.

- Remember, indicators have their advantages, but they should not overshadow the core principles of price action trading.

- Price action trading is a strategy that revolves around the analysis of price patterns, support and resistance levels, and market dynamics.

- On the other hand, when a stock’s price falls, there will be a point where buyers see an opportunity to purchase the stock at a discounted price.

During a sideways phase, the price moves sideways in a usually clearly defined price corridor and there are no impulses to start a trend. I would like to know more about Price Action trading, but I don’t have the resources to take an expensive class. Rayner…you’re such honest people, and really big ♥ . Hope you’re always healthy so you can contribute and spread this amazing content.

Technical analysis as a practice is a derivative of price action since it uses past prices in calculations that can then be used to inform trading decisions. A lot of theories and strategies are available on price action trading, many of which claim high success rates. However, traders should be aware of survivorship bias, as only success stories make news. No two traders will interpret a particular price action in the same way. Each trader has their own interpretation, self-defined rules, and understanding of behavior.

Stage #3: The Distribution Stage

Im just learning from an indian mentor who has won the best asian forex trader award in Hong kong at 2015. He also strongly recommend to avoid all coloring indicators, he just follows price action. He is still doing very successfull in fx trading also a very good trainer too. What if we lived in a world where we just traded price action strategies? A world where traders picked simplicity over the complex world of technical indicators and automated trading strategies.

Scientists Grow Whole Model of Human Embryo, Without Sperm Or … – Slashdot

Scientists Grow Whole Model of Human Embryo, Without Sperm Or ….

Posted: Thu, 07 Sep 2023 03:43:19 GMT [source]

It takes practice, experience, and a combination of technical indicators to spot and confirm a trade setup. However, other traders may start taking profits around 60% to 100% of the move to be safe. This is because there’s always a risk that the price could reverse or move against the trader’s position, resulting in losses. Now, when we talk about turnover between buyers and sellers, we’re essentially talking about the battle between demand and supply.

You look at trends, patterns, and potential trade setups without considering complex factors like fundamentals. It’s about trading what you see, rather than speculating on what you think might happen. Then, you can formulate proper trading decisions that are according to the price action of the markets. I found this very comforting;

I had a stroke and couldn’t do my profession anymore to earn money, but I can attempt to trade. I was prepared to learn all the different indicators, but your short video tells me I don’t need to; which takes a lot of anxiety from me.

Simple Price Oscillator Trading Strategies

So, for example, if we’re in a bullish trend and we see a correction, the Ross Hook pattern would be when the price breaks out of that correction and continues the bullish trend. For example, let’s say you’re looking at an asset that’s been in an overall uptrend for the past year. If you look at the monthly chart, you might see a clear upward trend with a few small dips along the way. The reward-to-risk ratio (RRR) is among the most important metrics that traders use to evaluate the potential…

Woman’s Mystery Illness Turns Out To Be 3-Inch Snake Parasite In … – Slashdot

Woman’s Mystery Illness Turns Out To Be 3-Inch Snake Parasite In ….

Posted: Wed, 30 Aug 2023 03:51:28 GMT [source]

Now if you want to see the discover the secrets to chart patterns, then click here to find out. Now once you understand the 4 stages of the market, then you’ll know which Price Action Trading strategies to use in a given market condition — and you’ll never be “lost” again. At this point, the market is still in equilibrium with both buyers and sellers on equal footing. So, when the price rallies back to Support, this group of traders can now get out of their losing trade at breakeven — and that induce selling pressure.

Candlestick patterns cheat sheet: How to understand any candlestick pattern without memorizing a single one

Since March the 19th till now I have put all my focus into trading on Price Action only. I currently have a 96% success rate with ever increasing returns. Price Action trading is in my humble opinion the best way to maintain a successful, and growing sustainable trading account and Trading experience all round.

Deja una respuesta