Save on an effective Va Mortgage for 2nd Domestic

In the example of a significant difference out of route, you may decide to not ever sell your own early in the day home and just book they, utilizing the money to help you buy the loan. You to as well is in the range of one’s Va program. In reality, it does not have to get a big change away from channel disease. You are able to just want to secure the previous home since an money spent. The fresh Va tend to, although not, would like you to show you may have rental administration sense if you are going to use a past residence given that accommodations possessions. When you yourself have got property government providers working on previous rental systems, that may also qualify.

The overall response is no, but again it’s a matter of timing. For folks who go out with the intention of to get a special household while the a secondary domestic, that’s a zero. However,, if you purchase a different sort of home and also you desire to use the early in the day household once the a holiday home, there is nothing in the way of your carrying out one. You just need to make sure the new house can be your newest house, meaning your primary quarters. Along with if you’re close to retiring throughout the armed forces, you may want to buy a property that will be in the a secondary attraction. In this case, you have 1 year to move in the, however it should end up being your primary residence once you retire.

Just how to Restore The Entitlement

If you find yourself working with multiple Virtual assistant guaranteed financing, finding out and you will monitoring the entitlement takes a little effort. Since Virtual assistant mortgage program can be used many times throughout yourself, its worthwhile to make sure you restore your own entitlement after you repay a mortgage. Officially emailing the brand new Virtual assistant when one of the mortgages try complete enables you to make use of your full entitlement because you go after an effective Va financing having next domestic, or even more Virtual assistant guaranteed finance later on.

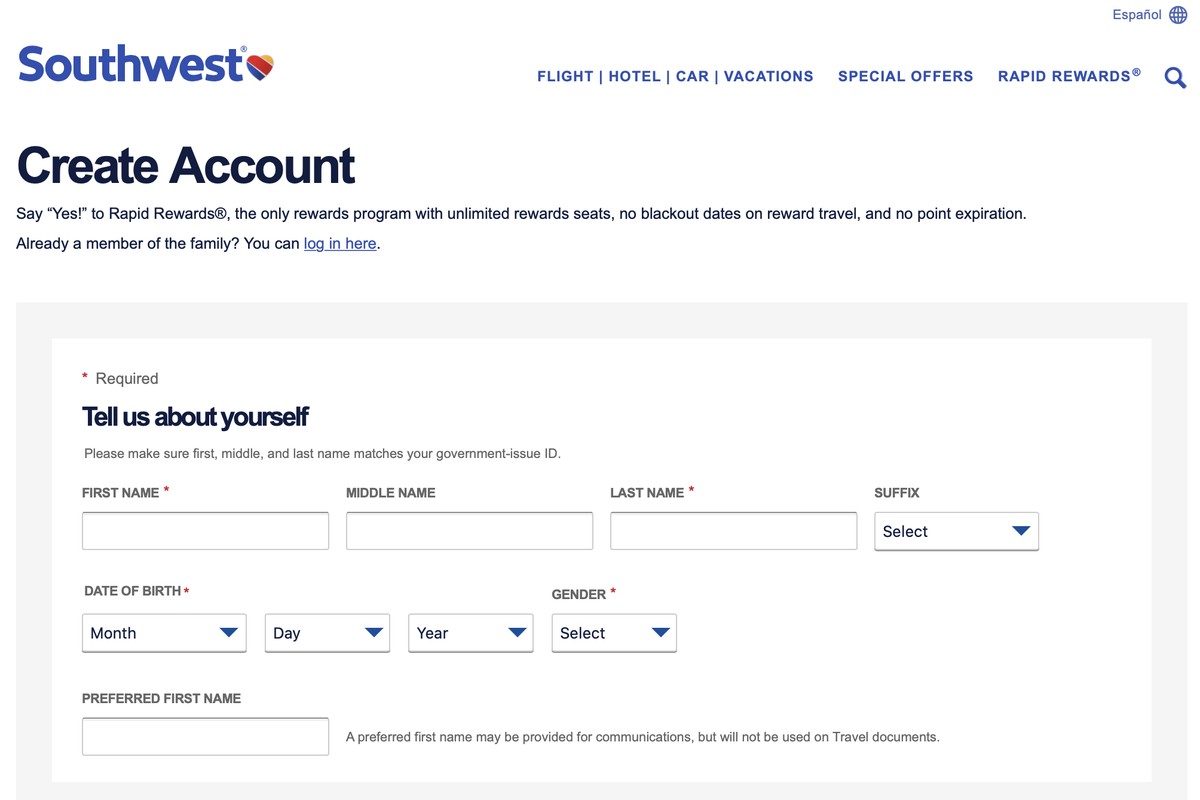

Repairing your own entitlement setting altering the COE, and there is a two-webpage concept which explains ideas on how to do this, as well as a downloadable form that you’ll need certainly to availability.

How come hooking up which have Home having Heroes help? With a personal financial to your benefit and you may letting you which have the fresh new either-cutting-edge rules of the Va is one step regarding the right assistance. House having Heroes have a network out-of home loan specialists who happen to be well-qualified on the Va mortgage program. Also dedicated to enabling armed forces users and you will pros while the a way to thank all of them for their service.

This option rocks. My agent is unbelievable. While the a first and initial time house visitors the guy offered the information and you can direction I desired. Marc, Navy, ordered a house for the Iowa.

Together payday loans without checking account with personal lenders, you are helped by us get a hold of a real estate agent, as well as name companies and you will family inspectors. The whole class will bring you of beginning to closing, as soon as your personal into the a property, we shall give you a character Perks check that averages $step 3,000 once you get a home, $6,000 when you trade, might assist you with devices, seats or renovations. Sign in online right now to talk to a person in we exactly how we could help you and you will help save you some great money in the method.

Get your Character Benefits!

The brand new Virtual assistant Certificate out-of Qualifications is but one of your own very first things tend to come upon when you start exploring the fresh new Virtual assistant house loan benefit. The fresh COE is really what it may sound eg: they verifies on the Va Mortgage processors which you see qualification standards toward system.

Deja una respuesta