A lender exercise usable security since the 80% of the property value the property without the loan equilibrium

Collateral explained

If you are paying down your financial, otherwise your residence has increased inside the really worth, maybe you have accumulated specific collateral. Exactly what you are going to that mean to you personally? Unlocking your home security could allow you to improve, fix your home if you don’t put money into a special assets.

Email address my show

This particular aspect can help you email a listing of the brings about on your own otherwise display it having anybody else. Susceptible to their concur, we can also assemble your personal suggestions to provide to your our email list in order that we can give you related pointers, for example industry status and provides on the no checking account payday loans Herlong CA the products that we consider get attention your.

Susceptible to the consent we’re going to gather a guidance to become into our very own mailing list. By the subscribing to the email list, youre agreeing we may use your pointers in order to deliver related recommendations such as for instance business standing and offers on the the products that individuals consider will get appeal your. Subject to certain exclusions necessary for legislation, you could demand to access and best your own recommendations if you find yourself i shop it. So you can improve your personal data or selling needs, or create a confidentiality enquiry otherwise ailment, please consider the Privacy within or call us on 1300 130 467.

Thank you so much

You could potentially unsubscribe at anytime. Westpac cannot send you an email asking for debt guidance otherwise send you a link which can show you to help you an indicator-in web page, asking to confirm otherwise improve your account details, PIN, passwords otherwise personal data. Keep your program protection cutting edge. For more information, visit

Mistake

Family equity is the overall property value the property that you in fact very own. For those who have home financing, it’s computed as difference between how much you owe this new financial on your home loan additionally the total value of this new property. Collateral is commonly accumulated throughout the years because you reduce your financial with repayments and also as industry value of the house or property increases.

A simple way away from knowing the style is always to suppose your offer your current house otherwise investment property now and shell out of their home loan completely security ‘s the amount of cash you would have left over.

Collateral often is calculated based on a lender valuation of the possessions, subtracting that which you currently owe on your own financial (it’s really worth with the knowledge that a bank valuation spends some other criteria and you will might be below a real estate valuation). So, such, when your market value of your house is $850,100, plus a great loan equilibrium are $five-hundred,one hundred thousand, you have doing $350,100000 out of collateral. You are able to more or less work-out the security using this type of calculator.

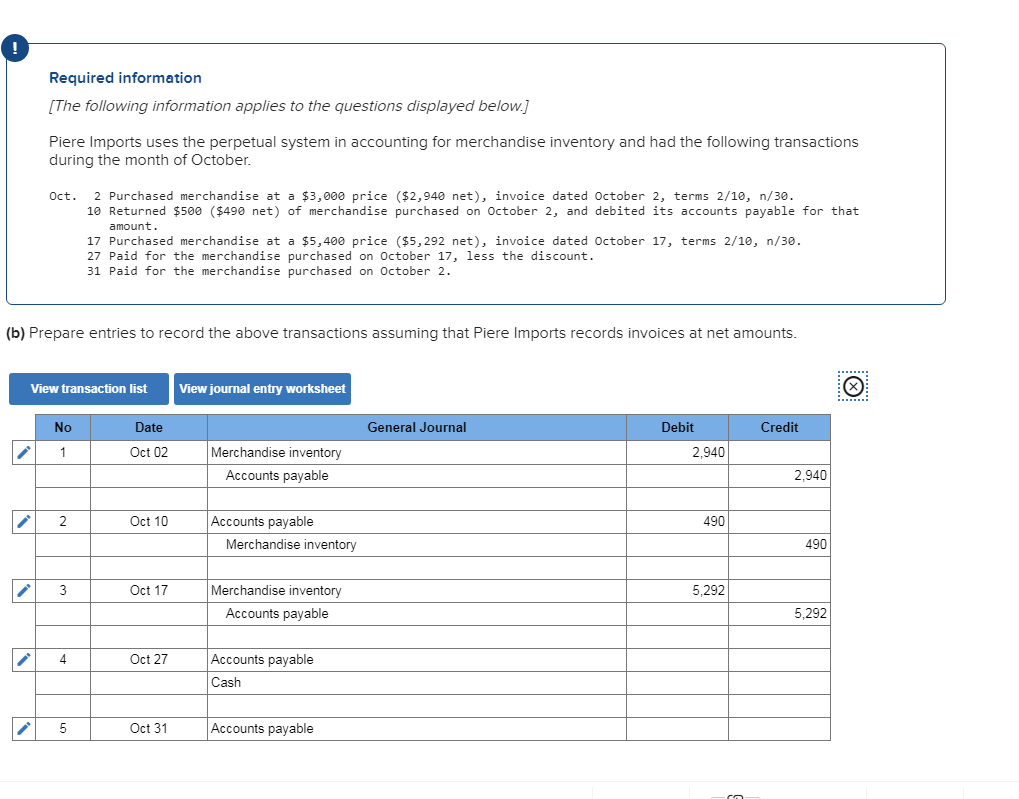

Eg, say your home is appreciated within $800,100000 along with a home loan out-of $440,100. Your own lender have a tendency to assess 80% of the property value the house 80% regarding $800,100 was $640,one hundred thousand. It means their usable equity is calculated given that $640,one hundred thousand (80% value of) without $440,000 (loan dimensions) = $200,100000. Your ount when it comes to a home loan improve otherwise credit line protected facing their available security.

Some other component that loan providers always account for ‘s the borrower’s capability to provider the borrowed funds. Even though you officially enjoys a certain amount of available collateral, should your money, expenditures and full obligations don’t allow one to easily pay the fresh new complete loan amount, you then ount you could afford, rather than the full amount of collateral.

Deja una respuesta