As the desire-only several months stops, you should make highest costs comprising both desire and you can principal money

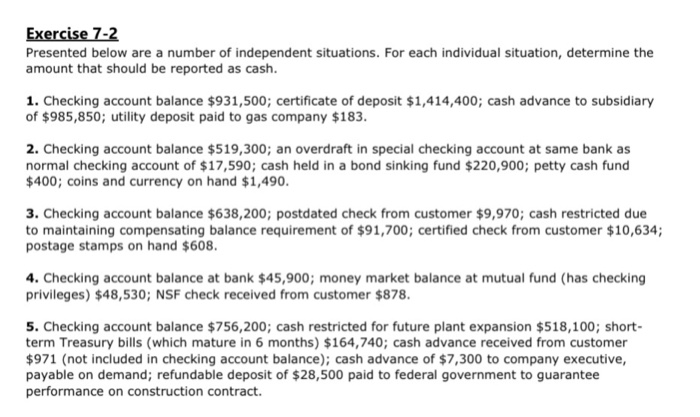

In this article:

- Just how Notice-Only Mortgage loans Work

- Benefits and drawbacks of interest-Just Mortgage loans

- Just how to Qualify for an appeal-Simply Mortgage

- Choice Mortgage Choice

- The bottom line

With an interest-just mortgage, your use the amount you ought to loans a home, but then generate payments one to just wade to the attract more a lay few years.

An interest-only mortgage can mean all the way down 1st monthly obligations than simply you might keeps having a conventional home loan, however, greater attract costs overall. An alternate disadvantage is that you would not collect any guarantee in the property while you are while making repayments one simply go into notice.

How Notice-Simply Mortgage loans Really works

- A first several months normally long-term three in order to a decade, when you only pay just interest towards financing dominant

- A keen amortization stage, when you will be making repayments with the both interest and dominant for the the loan

From inside the amortization stage, money was planned very much like they might feel having a traditional mortgage: A leading percentage of early costs wade with the focus costs and you may a relatively tiny fraction covers dominating (and accumulates family collateral). The bill gradually shifts over time, to make sure that by the end of the payment title, money lies nearly entirely regarding prominent money, in just a tiny piece supposed toward desire.

Observe that this new amortization phase of an attraction-merely loan normally advances dominating repayments more a notably shorter duration several months than just similar antique mortgages perform: For the a thirty-seasons $300,000 attention-just home loan that have a beneficial ten-12 months desire-simply stage, including, dominant payments was dispersed more an excellent 20-year several months, and thus he is usually greater than that they had get on the same antique financing, that have dominant payments try pass on all over all the thirty years of your own mortgage term.

What if you happen to be purchasing a $400,000 home with a great 20% downpayment out of $80,000. That’d suggest you may be borrowing $320,000. When you get a thirty-12 months notice-simply financial that have a great 10-seasons very first label and you will an annual percentage rate (APR) off 6.8%:

And when you make no extra repayments for the desire-simply stage of the loan title, your repayments when you achieve the amortization phase usually basically be the same as if you would applied for a beneficial $320,000 antique mortgage with a great 20-season term on 6.8% Annual percentage rate. Excluding property taxes, insurance policies and other possible costs, the latest Experian Home loan Calculator signifies that the payment manage ascend to on $2,443-a rise from nearly thirty five% along side money you’d create from inside the notice-just several months.

This example takes on the mortgage provides a fixed interest rate, but most focus-merely lenders is adjustable-price mortgage loans (ARMs), which have prices that may changes a year which have action into the a specific standard directory speed that will will vary by loan and lender. Inside the surroundings having rising rates (including our company is viewing in early 2022), monthly payments increases substantially based on for each and every yearly changes out-of a keen ARM’s Apr.

Advantages and disadvantages interesting-Only Mortgage loans

![]()

All the way down initial costs: Inside notice-only stage regarding an attraction-simply home loan, monthly premiums are usually http://www.paydayloancolorado.net/swink lower than men and women on the an equivalent old-fashioned financial, which includes each other attention and prominent.

A lot more payments can lessen fee matter: When you can be able to build a lot more money on an attraction-only mortgage, implementing the individuals money contrary to the mortgage dominant can be lower the number of monthly installments. When you look at the initial phase out-of a destination-simply mortgage, interest percentage is calculated with the a fantastic principal on loan, therefore applying extra costs toward dominant tend to lower notice fees and lower monthly payments. Reducing outstanding principal into the loan’s interest-simply stage also can decrease the sized the fresh new costs possible getting billed because the mortgage transforms for the amortization stage.

Deja una respuesta