Do Ally Lender Bring Home loans in my Urban area?

This has been an excellent roller coaster for Ally’s home loan products. Ally Lender first started as the a division regarding GM inside 1919, broadening car loan financial support to a wider variety off consumers. Ally released its first mortgage offerings in the mid-eighties. Yet not, in the present houses drama, the firm got big attacks to help you their home loan business. The fresh new losses was indeed very significant you to definitely Ally . By , it got avoided giving one the fresh new financial circumstances. In late 2015, Friend announced its decide to re-go into the home loan globe. Ally Household, their lead-to-consumer financial offering introduced when you look at the .

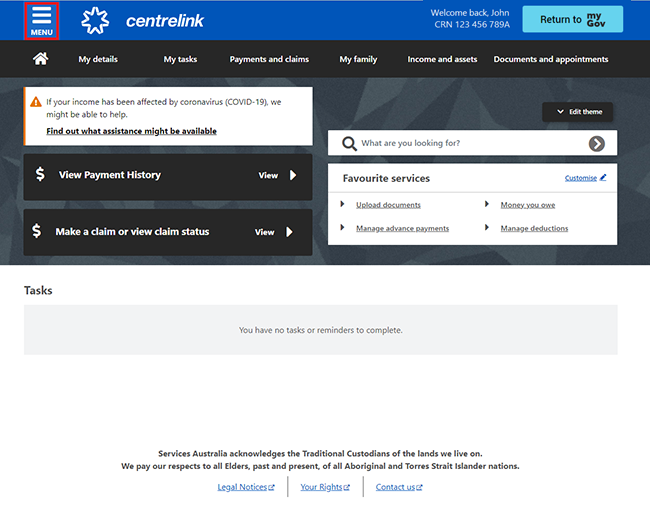

And Ally House, the firm also offers a great deal of most other lending products and you can qualities across the banking, handmade cards and you will assets. Friend Bank works entirely on the web, definition there aren’t any bodily places that you can check out. Although not, with no twigs demanding repair, Ally might be able to provide among the better rates and affairs.

Places Served by Ally Financial Home loan

Friend Financial also offers mortgages in forty says, as well as the Area away from Columbia. The organization does not originate mortgage brokers into the Hawaii, Massachusetts, pshire, Ny, Las vegas, nevada, Virginia, Vermont and you will Wyoming.

But not, as an on-line-merely financial, Ally does not have any real locations. And also make right up for this, Friend https://cashadvancecompass.com/loans/payday-advance-app/ have an easily navigable webpages and you may nearly twenty-four/eight support service availableness over the phone. That being said, when you are someone who firmly prefers to meet with a loan coach otherwise bank member directly, Friend Financial is probable not the mortgage lender for your requirements.

What sort of Mortgage Do i need to Get Having Friend?

Fixed-rate financial: A predetermined-rates mortgage works just how it sounds: the pace remains an identical in the longevity of the mortgage. The most common choices are this new fifteen-12 months and 31-year terms. Ally also offers men and women name lengths, and terms of 10, 20 and you will 25 years, for every single and their individual interest rates and yearly percentage prices. A fixed-rate mortgage will bring a good idea for all those trying sit in their belongings for a bit longer of your energy which have steady home loan repayments.

Adjustable-rate financial: A variable-rates mortgage, or Arm, typically begins with a relatively low interest to possess a flat few years. Next basic period, the speed usually fluctuate considering the directory. This is why will eventually throughout your mortgage, you could benefit from a highly low-rate. But not, the contrary is additionally correct, where you could find yourself with a higher rate. Palms tend to work best for people who want to circulate or refinance inside many years.

When you see Possession, it isn’t as simple as discovering the fresh mortgage’s term size. Instead, a couple number will be provided. The original matter claims along the new basic months whenever you are the next represents how often the interest rate will change. The most popular Arms term is the 5/1 Case. It means the newest basic rate of interest lives in place for five decades after which it, the pace have a tendency to readjust on a yearly basis. Friend Bank offers 5/1, 7/step 1 and you may 10/step 1 Palms, for each and every with its own interest and Apr.

Jumbo mortgage: A beneficial jumbo mortgage was a loan more than the fresh conforming mortgage restriction for unmarried-family land inside a specific state. In the most common of the country one to restrict is actually $548,250. This is the restriction matter you to definitely good Freddie Mac otherwise Fannie Mae loan is right back. Although not which amount can transform according to county and you may state you are looking to find property inside. In a number of higher-costs counties, the new restrict was highest. By firmly taking away a mortgage that’s higher than brand new limitation, you will find an effective jumbo loan. That have Ally Lender, you can aquire any of the repaired-speed otherwise variable-rates mortgage loans given that an excellent jumbo loan.

Deja una respuesta