Do you know the Affairs one to Decides Financial Eligibility?

Do you wish to get a home loan? One which just proceed to find yourself all of the nitty-gritty, you ought to look at the home loan qualification. According to the eligibility away from a home loan, One should be a resident out of Asia and may getting more than 21 yrs . old while you are obtaining the home mortgage. According to the lender otherwise lender your location implementing getting a home loan, needed plenty of records which can be expected to become observed. To learn more and more Mortgage Qualifications, why don’t we take a look at the certain circumstances that determine your home mortgage Qualifications:

Age:

Your property mortgage qualification is projected to own a certain months titled tenure. Their tenure depends on how old you are, and your capability to pay it back while in the a particular period. The art of an early candidate to spend right back their mortgage differs from that of a center-old otherwise resigned person. financial individuals in lots of phases of the existence face pressures that are different. Banks consider like factors whenever you are evaluating software. Because of the believed and you will cost management really, you’ll beat brand new barriers folks of your actual age class deal with, and get the simplest alternative available to choose from.

Work Position:

Your employment updates can be extremely important as your money. Being employed in the an MNC or a reputed personal otherwise private business team enables you to way more reliable since the a debtor. Including, when you’re a personal-operating private, up coming loan providers are more inclined to offer you a great approve into flexible terminology compared to the people having an unstable work or business.

Income:

This doesn’t need then reason. Your earnings highly impacts what number of money financial institutions and you may monetary establishments are prepared to give you. The better your income, the more how much cash banks are willing to give you. All lenders believe you to definitely individuals should have a specific amount of earnings is eligible for a home loan. It, needless to say, varies consistently together with your community. Your house loan qualifications was calculated predicated on your earnings.

Degree & Experience:

When your educational back ground and you can functions feel is impressive, the chances of the bank sanctioning your property loan is large. For-instance, if you find yourself good salaried staff member, you really must have at least two to three several years of functions sense become entitled to a home loan. Likewise, while you are a home-functioning private, your organization need to be functional for many decades, with sufficient bucks payouts and you will profits. Tax returns must have recently been submitted within the organization’s term. Your informative background and you will performs feel predict field progress and you may balances rather well.

Brand of Work:

The type of a job will have a viewpoint on your family mortgage eligibility. Banking institutions worry about regardless if you are salaried payday loans Bow Mar, or whether you are a home-Functioning Top-notch (SEP) or a home-Functioning Low-Elite group (SENP). The fresh qualifications requirements are different depending on their types of a career. Repeated work alter can impact your potential customers of getting a property mortgage.

Credit history:

A credit score offers a very clear photo to the lender given that to the manner in which you provides treated your own debts as well as have just how able to youre out of paying down the home loan. Prior to sanctioning the borrowed funds, loan providers measure the credit rating of the applicant, that it vital that you carry on a wholesome credit history. Unfortunately, if you’ve got a very low credit rating or of numerous pre-current funds, your application is also refused.

This isn’t merely the principal additionally the interest elements of their EMI that you should need to worry about. Its also wise to have to plan money to possess margin money to the home loan. The lender financing simply 80 per cent of your market value from the property titled (LTV) we.age. Loan-to-Worth Proportion (90 per cent in case there are mortgage brokers lower than Rs 30 lakhs). This new borrower need certainly to arrange new 20% (or ten percent while the instance can be) of market price of the home. The new advance payment you will be happy to generate get a huge influence on your property loan qualifications.

Industry Lending Prices:

The fresh Set aside Bank off India’s (RBI) regulations and you may business lending/rates of interest possess a giant affect your debt and advances. Rates influence the worth of borrowing money. The higher the rate of interest, the better would be the worth of your residence financing. In simple terms, rising credit pricing commonly raise inflation and you can discourage borrowing, and then make offers more desirable. Decreasing interest rates create borrowing more attractive.

Just how to Estimate Your house Mortgage Qualifications:

Even when this type of details can differ away from lender in order to lender and you can good partners banks eters to complete, whatever you wish to accomplish is, discover new calculator webpage and you may type in or get the adopting the

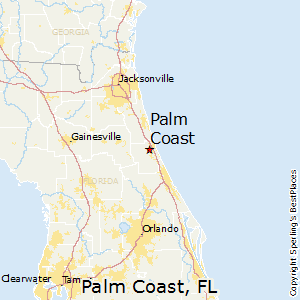

- Your local area

- Ages or big date out-of birth

- Pick the internet month-to-month income

- Prefer other money

- Discover mortgage period you’d favor

Deja una respuesta