dos. Looking and you may securing the loan mortgage

- Immediately after settling the purchase price, you would have to spend the money for option payment so you can secure the Option to Purchase (OTP) on the provider. So it grants the private straight to choose the property within this a specified months.

- Get an in-Idea Recognition (IPA) out of a lender thereby applying to possess home financing ahead of exercising the newest OTP to be certain you’ve got the needed funds.

- Do so the fresh OTP from inside the agreed timeframe, indication product sales and get Arrangement, afford the balance dumps, and you will over most of the courtroom formalities to help you finalise the house import.

Immediately after far efforts, you have eventually receive your ideal family toward resale industry. You simply can’t hold off to help you renovate the house and you will move around in, but several steps are needed between securing the possibility to find (OTP) and you can to be the particular owner. Keep reading to ascertain exactly what needs to takes place one which just have the techniques on your hands.

A solution to Buy (OTP) is actually an appropriate bargain when you look at the a property you to grants a buyer new exclusive to pick a home contained in this a designated period (generally speaking 2 weeks to have individual attributes and you will step 3 months having HDB) , in exchange for an alternative payment. When your consumer doesn’t do it which proper into the choice months, owner gets the right to forfeit the option fee s and you can lso are-list the home for sale.

step 1. Procuring the fresh new OTP

Pursuing the speed negotiation, the seller (or their designated broker) continues to material the option to purchase (OTP). An enthusiastic OTP is actually an agreement one to, after the percentage of one’s choice percentage, grants a substitute for the goal consumer to get the home in the a consented rate within this a conformed several months (normally two weeks, although this cycle will likely be worked out within provider and you may the customer).

Whenever you are there isn’t a prescribed self-help guide to the exact articles or phrasing from conditions contained in this an OTP, very possessions agencies normally play with layouts provided with their respective companies. Perform carefully opinion this new conditions spelt out as the sale away from the home could well be bound by the newest contractual conditions placed in it.

To help you procure the fresh new OTP, you would need to afford the option payment, always step one in order to 5 % regarding price having personal belongings (negotiable) or not over S$step one,000 to own HDB flats.

Just before achieving the OTP and you will loan application amount, you will want to already have an idea of simply how much you has actually easily accessible plus CPF -OA balances. It is a habit to acquire an in-Principle Approval (IPA) away from a financial.

Whilst not legitimately joining, protecting the new IPA will give you a quote of the number of financial youre eligible for when shopping for a home, reducing the likelihood of shedding their put should you decide are not able to safer an interest rate.

Once you place your alternative payment, try to sign up for a home loan into the bank prior to working out the fresh OTP.

3. Exercising the newest OTP

As the financial could have been authorized by the lender, buyers are able to proceed to do so the newest OTP within the given timeframe, then enter into a sales and get Agreement (S&P) with the vendor. Assets purchases are usually techniques, nevertheless assistance of a lawyer to operate for the conveyancing and you can homework is necessary.

As an element of S&P, customers must proceed to afford the equilibrium deposit (4% from purchase price for individual characteristics much less than S$5000 to possess HDB ). The newest business was named from if the OTP isnt properly exercised for the specified months, and choice percentage is forfeited.

Remember to blow the Buyer’s Stamp Responsibility (BSD) (estimated step three% from cost) into the authorities contained in this 2 weeks regarding exercising the OTP, together with More Buyer’s Stamp Obligation (ABSD) if you own more than one possessions.

The lawyer will then hotel a caveat towards the property. It is a proper observe of interest for the assets, stopping it of on the market many times.

cuatro. Pre-end

Up on exercising the fresh new OTP, both you and the vendor would have decideded upon a night out together out-of end with the deals, normally in approximately ten in order to several weeks’ go out. During this time period, their designated lawyer will run the necessary inspections to be certain that possessions will likely be offered having a flush name, with no almost every other caveats lodged facing it or people encumbrances. During this time, a proper valuation of the home might also be accomplished by your bank’s or HDB’s appointed appraiser.

On your part, get ready to submit people expected files with the financial or even the bodies, making the brand new advance payment as needed.

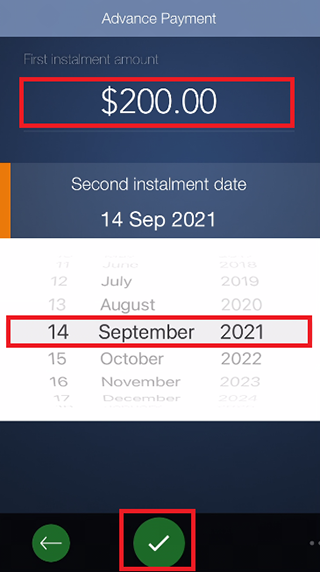

I f youre having fun with an HDB loan, this new deposit is actually 20% of your own price, which can be reduced having fun with cash, CPF Normal Account (OA) deals, or each other. If you utilize a financial loan, the fresh down-payment try 25% of the price, which have at the least 5% required in cash as well as the leftover 20% having fun with often cash and/ or CPF OA deals.

Committed pit allows owner to maneuver from the possessions, once they have not already, also to make certain dated furniture was thrown away, otherwise consented fixes finished. Which naturally hinges on brand new arranged conversion process terms while you are getting the possessions in the as-in status otherwise vacant hands.

Eventually, on the day of achievement, create a trip to the lawyers’ work environment the place you might possibly be theoretically joined just like the happy the fresh proprietor of the home. By now, their lawyer might have currently adopted upon transferring the rest 95% for the seller, letting you collect the new secrets to your dream household.

Create remember personal loans if you have bad credit that people repair costs, possessions taxes and other costs regarding the assets usually takes perception from this date off achievement.

With these past steps in place, you might commence any desired restoration and start converting the fresh new freshly ordered equipment into the dream domestic.

Begin Think Now

Listed below are some DBS MyHome to work out the fresh new sums and acquire a property that suits your allowance and you can choices. The best part they cuts out of the guesswork.

Alternatively, prepare which have a call at-Principle Acceptance (IPA), so that you features confidence how far you could potentially use to have your house, enabling you to know your financial allowance truthfully.

Deja una respuesta