Essentially, the first financial is set at 80% of your own house’s really worth additionally the second mortgage is actually for 10%

Investing more substantial downpayment off 20% or higher, if possible, usually bring about degree having lower rates. Ergo a bigger deposit will normally result in the lower amount paid off toward attention to own borrowed currency. To possess traditional money, purchasing about good 20% down-payment when buying a property eliminates the need for Individual Financial Insurance policies (PMI) money, that are substantial month-to-month fees you to definitely make sense throughout the years.

This is certainly also called an 80-10-ten financing

One of many risks on the and make a more impressive downpayment ‘s the probability of a depression. In the example of a depression, our home worth might lose, and with it, the newest cousin profits on return of huge down payment.

And then make an inferior advance payment likewise has its positives, the obvious becoming a smaller amount due on closure. Generally, there is a large number of some other possibility will set you back involved in the brand new loans being used having a down-payment; money always build a downpayment can’t be put and come up with renovations to increase the value of your house, pay back large-notice obligations, save having senior years, help save to own an urgent situation fund, or invest for a go at a high get back.

Downpayment dimensions are also essential in order to lenders; essentially, loan providers like larger down money. The reason being huge off payments lower chance by securing all of them contrary to the various situations that may slow down the worth of new purchased house. While doing so, borrowers risk dropping the down payment once they are unable to build payments into the a home and you may fall into foreclosure. As a result, off repayments try to be a reward getting individuals to make its mortgage payments, which helps to control standard.

Savings-Very home-buyers cut back for their down money of the setting aside savings until they visited their wished target, be it 20% otherwise 3.5%. Obtaining the offers for the a destination-hit account like a checking account or perhaps in Certificates away from Deposit (CDs) offer the ability to earn some appeal. Whether or not position advance payment savings when you look at the greater risk assets such holds otherwise online personal loans Illinois bonds can be more profitable, it is very riskier. To learn more throughout the or even manage calculations related to offers, kindly visit the brand new Discounts Calculator. To find out more on the or perhaps to do computations related to Cds, please visit the newest Computer game Calculator.

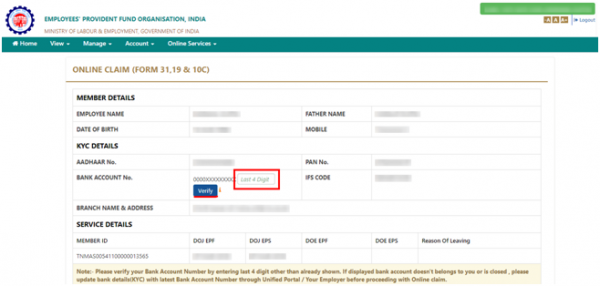

Piggyback Mortgage-Where your house-client does not have any sufficient finance to help make the necessary down-payment to possess a home purchase, they’re able to just be sure to split its mortgage toward a couple loans. A beneficial piggyback mortgage is when a couple of age domestic. The remainder ten% comes from your house-consumer’s deals while the a downpayment. Home-people I otherwise jumbo capital.

Deposit Assistance Apps-Local state otherwise urban area governing bodies, regional property authorities, and you will charitable foundations either give gives so you can very first-time domestic-buyers. State-large apps can be acquired to your HUD web site. Down payment help is constantly merely arranged to have you need-depending individuals purchasing a first quarters. Gives will come in the way of money applied to a great downpayment or an interest-100 % free loan meant to enhance a main mortgage. Features must become repaid should your residence is offered.

Individuals usually still have to possess decent borrowing and noted income

Gift Financing-FHA fund support the new downpayment becoming something special regarding a pal otherwise relative, and the entire advance payment is viewed as something special just like the long as there is actually a present page saying that its something special that will not need cost.

IRA-The main led to good Roth IRA (individual advancing years account) is withdrawn versus penalty or tax. In contrast, contributions of a classic IRA might possibly be at the mercy of regular money taxation also a ten% punishment whether your efforts was withdrawn ahead of the age of 59 ?. not, there’s an exemption that enables someone to withdraw $ten,000 away from one another type of IRAs (and additionally money to have good Roth IRA) versus punishment otherwise tax for the pick, resolve, or restorations out of a primary home. Money also can legitimately be employed to purchase property getting a wife, parents, college students, otherwise grandchildren. The actual only real caveat is that the domestic-visitors is only provided 120 weeks to expend the taken financing, if not he’s responsible for make payment on penalty. Partners is also per in person withdraw $10,000 off their particular IRAs to help you spend $20,000 into the down-payment. The new $ten,000 restriction try a life restriction.

Deja una respuesta