Particular mortgage o?cers call it a finance suggestion

exactly how many days your interest rate try locked. Whilst the GFE is beneficial with techniques, it’s very without a few areas:

Trying to find home financing based on GFEs was di?cult, just like the a loan provider will not always point a great GFE if you don’t provides understood a house

It does not let you know who is make payment on title charge, that differ built where in the united kingdom you are to buy. When you look at the California, as an instance, who will pay brand new term charge is actually discussed included in the get arrangement. During the Utah, its fundamental regarding county-accepted, real-estate-get contract the provider pays for the latest owner’s title policy. This can be fairly complicated since, when you look at the Utah, the GFE will show a beneficial $dos,five hundred owner’s term rules percentage but doesn’t signify the brand new merchant pays which charges. Th e setting fails to let you know any and all credit paid back from the supplier, which will are different, depending on where you are and exactly how the purchase agreement try discussed.

It will not amuse total percentage. It suggests in case the monthly payment includes fees and you may insurance coverage, but it will not let you know exactly how much your total fee has been fees, insurance coverage, and you may people organization costs. Many people wish to know what the fee is going to become, plus people costs, to be able to not amazed on the day off closing.

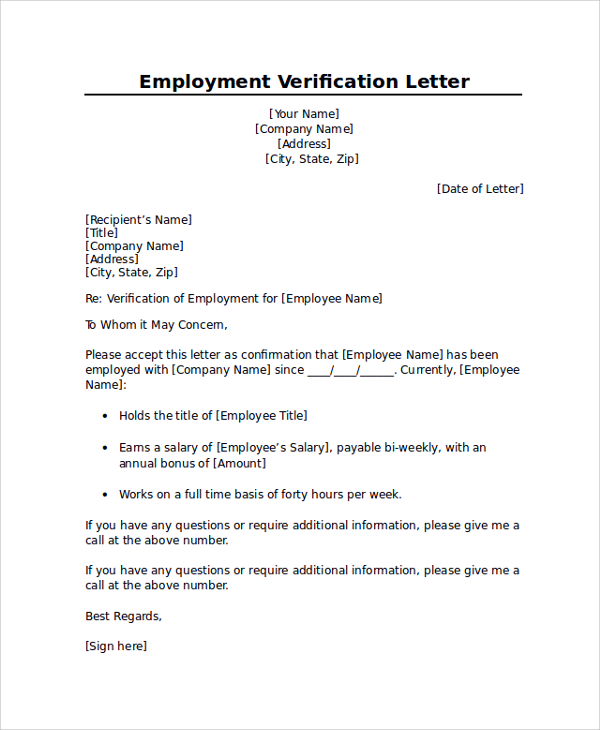

When shopping for home financing, thought requesting a payment worksheet or a funds offer one demonstrably itemizes most of the will set you back and all sorts of credit

It generally does not itemize in which all the dollars of your own closing costs is actually heading and to who. It teaches you lump sum payment totals out of closing costs.

It will not show whether the provider have agreed to spend any of your closing costs. New GFE get list $a dozen,000 in conclusion will set you back, but $step 3,000 of this is generally about seller’s proceeds to cover the fresh new owner’s identity plan. Each you buy arrangement, the seller could possibly get agree to shell out region or most of the kept $nine,000 of your closing costs. So, extent you find yourself in reality needing to come up which have during the closure can be hugely not the same as what exactly is uncovered for the GFE. Since the GFE departs out specific trick advice, such as for instance full payment per month and money to close, that’s probably the very first suggestions to you, extremely mortgage o?cers features one thing named an installment worksheet (having a good example of this form pick Appendix B on web page 131, otherwise visit UtahPhysicianHomeLoans/feesworksheet). Th elizabeth charge worksheet, or resource suggestion, are a more outlined file that shows an entire fee that have taxes, insurance policies, home loan insurance rates (in the event the appropriate), total sum of money had a need to intimate, and all the fresh loans that is certainly coming to you. Since the bank points a great GFE, it is a promise. Lenders can not make sure the GFE if they do not know whenever consumers are going to close, what the loan amount is actually, and you will just what cost are.

Do i need to Rating a homes Mortgage with a health care professional Mortgage? Yes. In a number of areas of the world, there are loan providers that will approve a property mortgage according cash advance loans installment Vermont bad credi to a doctor lender’s long-term financing acceptance. Usually, the development mortgage is actually used to buy the package and you can generate your house. It is a primary-title financing (3 to help you 12 months constantly) and should be distributed off as the home is situated. Given that residence is done, you are going to refinance into your doctor home loan, generally, a great 15-year or 31-year repaired mortgage, that’ll pay back the construction loan. Th e construction mortgage to own medical professionals would-be a difficult loan to find, but it’s available. Basically, finance companies you to out of er build finance are not regarding doctor financing organization, but we’ve been profitable for the securing all of them for readers once we normally question a lengthy-identity union to the the doctor loan system. The physician financial financial is, basically, offering a written approval towards financial making the design financing. Th is written recognition claims your bank features underwritten the fresh borrower and certainly will improve mortgage since the family construction is actually completed. Check out USPhysicianHomeLoans to own a listing of lenders who can bring medical practitioner design funds.

Deja una respuesta