Pros and cons from Tsp Loan: How Thrift Coupons Bundle Loans Make a difference Your money?

Will you be a federal staff or a good uniformed provider representative that have a good Thrift Savings Plan (TSP)? Provided taking out a tsp financing however, must comprehend the experts and you may possible drawbacks? Contained in this complete guide, we will delve into the realm of Teaspoon loans, exploring the mechanisms, masters, limitations, and you can dangers. Whether you’re contemplating that loan […]

Are you presently a national staff otherwise good uniformed provider associate that have a good Thrift Offers Package (TSP)? Given taking right out a teaspoon loan however, should understand the advantages and you will prospective downsides? Contained in this complete book, we’re going to look into the field of Tsp money, examining the mechanisms, masters, restrictions, and you can downfalls. Whether you are thinking about a loan to own an economic emergency, household purchase, and other means, we’ve got your covered with all of the extremely important facts to assist you make a knowledgeable decision concerning your later years savings.

Preciselywhat are Tsp Loans?

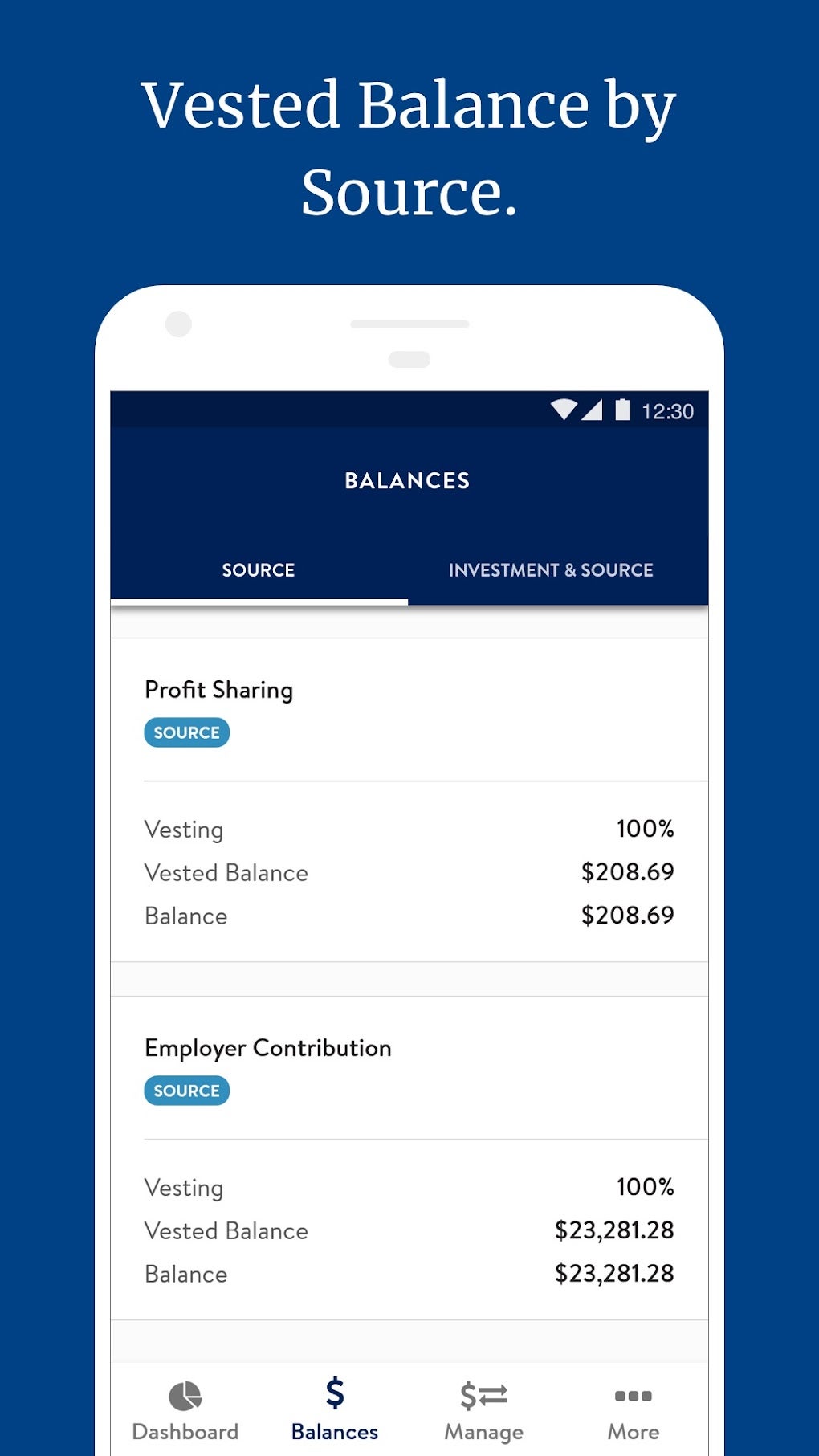

Teaspoon money try an element of one’s Thrift Offers Package, available for government staff and uniformed solution users to view financing using their senior years discounts. Much like an effective 401(k) mortgage, Tsp finance is actually subject to federal government laws and regulations, making it possible for users in order to use from their Tsp account benefits.

Procedure regarding Tsp Money:

$255 payday loans online same day Wisconsin

The borrowing from the bank processes concerns accessing funds from your own Teaspoon membership and paying down the newest borrowed matter that have desire more than a particular months. An interesting part of Teaspoon financing is that the interest paid off extends back into the Teaspoon account, effortlessly reimbursing oneself.

Advantages regarding Teaspoon Finance:

Tsp finance incorporate many perks which make them an interesting option for anybody trying to availability their retirement discounts for various intentions. Here you will find the secret masters:

- Low interest: Teaspoon money offer competitive rates than the antique finance, probably helping you save profit focus money.

- Zero Borrowing from the bank Inspections: As you’re borrowing from the bank from the finance, no borrowing from the bank inspections are expected, streamlining the loan software techniques.

- Flexibility: Tsp funds can be used for varied need, ranging from issues to buying a primary household, providing financial flexibility.

- Interest Productivity: The interest you only pay with the loan are transferred back again to your own Teaspoon account, enhancing your retirement coupons.

- Fast Fees: Teaspoon money allow for very early installment rather than taking on prepayment charges, providing economic independence.

Disadvantages off Tsp Fund:

- Required Charges: Borrowers is actually confronted with necessary costs towards the Teaspoon finance, which can include an additional expense towards the loan amount.

- Stunted Growth: By the withdrawing money from your Tsp efforts, the chance of funding development in retirement fund could well be dampened.

- Borrowing Hats: Teaspoon finance features credit restrictions, limiting the amount you have access to considering a percentage out-of your bank account equilibrium.

- Taxation Trouble: Incapacity to stick to loan payment direction can result in tax ramifications and you may possible charges, affecting your financial debts.

Ways to get a teaspoon Loan?

Getting a teaspoon mortgage pertains to a structured approach, encompassing certain actions to be sure a seamless and you can well-informed borrowing from the bank feel. Let us walk-through these very important strategies to help you from the Teaspoon application for the loan techniques.

Determine Loan Qualification and you may Loan Type:

Step one into the acquiring a teaspoon financing entails evaluating the qualifications according to their government a career position and you will determining in case your Tsp account balance matches brand new outlined endurance to own loan qualification. Concurrently, choosing the loan type of you to definitely aligns along with your demands is key. General-objective financing give reduced cost terminology, while residential financing, aimed at house sales, bring expanded cost episodes.

Influence Amount borrowed:

Carefully figuring the borrowed funds matter you need to borrow is crucial. Researching debt standards and you will fees ability is important to end reducing your retirement coupons if you find yourself assisting quick mortgage cost.

Done Called for Documents:

Thorough end of financing records is pivotal, specifically for domestic finance which need proof number one house purchase otherwise structure. Guaranteeing particular and complete files distribution is essential to help you expedite the fresh acceptance procedure.

Submit Loan Request:

Formally entry your loan demand is going to be finished from the Teaspoon web site or by the emailing a magazine loan application designed for obtain into the Tsp web site. Previous verification out-of records and you can attachments facilitates a delicate recognition processes.

Pay-off Loan since the Arranged:

Fast payments are crucial so that the constant replenishment of one’s later years funds, typically as a consequence of direct salary deductions. Sticking with the fresh new installment plan mitigates prospective charges and you may income tax obligations, shielding debt balance.

Teaspoon Loan Qualification and needs:

Knowing the qualification criteria having Tsp fund is important for a beneficial effective loan application. Key factors are government a career standing, lowest balance conditions, and you may specific loan products with varying fees periodsprehending such prerequisites are vital to navigate the mortgage application procedure effortlessly.

When you should Envision a tsp Loan:

Deciding if the of course to pursue a teaspoon mortgage is actually an effective significant choice one to warrants careful consideration. When you find yourself these types of finance offer a channel to access retirement offers, it’s necessary to weigh brand new activities less than and that a tsp financing would-be a feasible option. Through the problems, high-desire personal debt government, household orders, otherwise instructional activities, a teaspoon loan could possibly offer financial rescue. not, its important to measure the affect much time-identity economic expectations and you may later years offers just before going for that it economic means.

Conclusion:

Since we’ve traversed the landscape from Tsp money, we’ve bare new subtleties of its components, pros, challenges, and crucial considerations. Navigating the fresh new ins and outs regarding Teaspoon loans means a well-told means, aligning debt behavior with a lot of time-term retirement requires. Regardless if you are thinking about a loan to own immediate monetary demands otherwise enough time-name aim, ensuring a well-balanced method are crucial to suit your economic well-being.

Which have an intensive understanding of Teaspoon loans, you may be well-furnished to check the newest feasibility out-of a tsp loan and then make informed conclusion lined up together with your monetary ambitions.

what is qrius

Qrius reduces difficulty. We give an explanation for main points of our big date, responding practical question: «What does this mean personally?»

Deja una respuesta