‘Rich Father Bad Dad’ Author Robert Kiyosaki to your Their $1 2 Bi

Blogs

Silicon Area Bank committed to plenty of VCs along side many years, in addition to Accel People, Kleiner Perkins, Sequoia Financing, and Greylock. Today, keep in mind, another bank entitled Silvergate got merely folded (to own crypto grounds). When Silicone polymer Area Bank generated it statement to the March eighth, somebody bolted. Peter Thiel’s Inventor’s Financing told their portfolio enterprises to get aside, sooner or later pulling many. Connection Square Opportunities and Coatue Administration, as well as others, decided to give businesses to pull their funds, also.

Credit history companies dropped upon the work, once more. – Vip Stakes casino sign up bonus

«But We did not agree my fund.» Three almost every other older managers in a position to learn about financing panel functions don’t go back calls. A property within the Vegas had not educated a lower stage inside the ages. Enclosed by slopes, with a lot of property beyond your city belonging to the us government, it actually was easy to consider possessions is a limited commodity you to definitely do forever take pleasure in. The new bet multiplier depends on the blend of the count away from mines on the grid plus the amount of profitable cost shows. «When they locked our profile, We the good news is merely had to $865 in the membership,» she informed Newsweek.

CNBC Updates

Despite the downturn on the Far eastern monetary areas, Leeson is consistently promoting unusually Vip Stakes casino sign up bonus highest change profits 2. Barings Lender’s elder government failed to choose prospective warning flags, thoughtlessly believing that Leeson try only exceptional within his role. There’s never one wanting to know or analysis to your durability away from Leeson’s exchange procedures.

«Today, the firm doesn’t understand to what extent the company tend to manage to recover the cash on deposit from the SVB,» officials at the Roku authored away from what number in order to on the 26% of your business’s bucks. One to seemed smart at the time — long-term government loans could be considered regarding the easiest financing you possibly can make. But the worth of those ties began to slide after the Federal Set-aside already been elevating rates of interest aggressively to battle inflation.

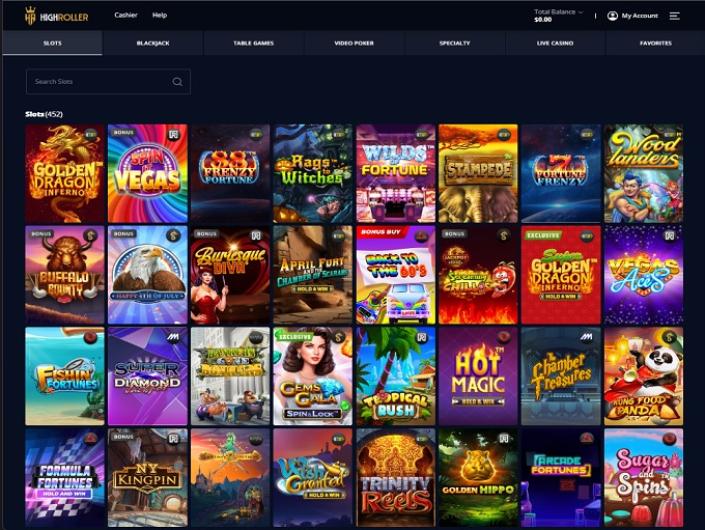

SlotoZilla try another site with 100 percent free gambling games and you may ratings. All the details on the website features a function in order to captivate and teach folks. It’s the new folks’ duty to check on your neighborhood laws ahead of to play online. As well, Kiyosaki dedicated to gold and silver, also uncovering a silver exploit inside the Argentina, later on obtained by Yamana Silver.

(If the financial crisis struck, the fresh FDIC increased the new covered amount to $250,000). Brokered deposits have emerged because the high-risk since they’re disloyal; rather than deposits painstakingly obtained regarding the people, brokered depositors are continually transferring to banks that offer the best interest levels. Whenever Gold State closed, they had regarding the $700 million inside the brokered deposits, from the 41 per cent of the overall dumps.

It turns out Becker and marketed $step 3.6 million from offers inside Silicon Area Bank’s parent team to the March 27th. This was a great pre-set up product sales — he recorded the newest records to the January 26th — although it does look like curious time! Becker try allegedly conscious of their own harmony layer, and you will a director away from a local Fed lender. He had to understand the fresh Fed would definitely remain increasing interest rates — I mean, basically knew it, he’d finest features identified they — and he needed to be aware that would be bad news to possess Silicone polymer Area Lender. And because of the many these types of liquidity situations — congrats, btw — nobody expected financing as they had all this bucks.

However the gossipy characteristics of Silicon Valley, and also the fact that too many of them businesses try entwined, generated the potential for a financial work on large to have SVB than simply it actually was with other metropolitan areas. Right now, gossip is traveling inside WhatsApp groupchats loaded with founders scrambling for cash. I suspect, as well, that we’ll start seeing fraudsters wanting to address panicky technology brothers, to extract more cash from their website.

Allfreechips Associate pages

Since the most from people can take advantage of playing rather than a good status, a small section confronts a patterns. Observe that it might be strange for everybody buyer property in order to drop off regarding the insolvency of a financial investment team. Ms. Musician said CIPF’s tasks are typically to afford shortfall anywhere between what is in reality remaining inside buyer membership and you may just what must have already been through it before the organization became insolvent. Rating methods to that it question from the examining should your financing organizations you handle are members of the brand new Canadian Buyer Protection Fund.

Mind dead liar dad

I discovered easy to use to evaluate the fresh video game, that have Great britain’s Got Ability as a standout, however the much time account confirmation techniques is basically an excellent bona-fide remove. Playing with Interac to put is basically effortless, nevertheless the hold off day-checked my personal work. While playing 100 percent free slots such as Money-box, I couldn’t let yet not, gain benefit from the best-level protection.

«That is going to go lower as one of the biggest instances of an industry reducing the nostrils off to spite the deal with.» Right now, because the dirt begins to decide on another financial snap-down launched recently, people in the fresh VC people try lamenting the newest part you to most other buyers starred within the SVB’s dying. PhillipCapital Band of Enterprises, as well as PCM, their affiliates and you may/or their officers, administrators and you will/otherwise personnel get very own or have ranks in the Issues.

But not, confidentiality issues kept irritating on the me, making it hard to totally relax. Penske Media, the largest buyer associated with the webpages’s parent company, Vox Mass media, advised The fresh York Moments you to “it absolutely was in a position should your organization necessary additional financing,” for instance. That’s an excellent, while the Vox News features “a hefty intensity of cash” at the Silicone Area Lender. Needless to say, the other issue is that a lot of buyers were in addition to banking from the SVB, too. «A significant part of the U.S. banking system are overexposed in order to commercial a home,» states financial expert Gerard Cassidy away from RBC Funding Locations. Government Reserve research inform you commercial real estate loan delinquencies increasing almost 4 times involving the basic quarter from 2007 plus the third quarter of 2008.

President Joe Biden commented on the condition in an attempt to guarantees the public, saying the fresh Silicone polymer Area Bank money create still “be there when you need them” rather than requiring a taxpayer-financed bailout. The bucks getting used doesn’t are from fees, as an alternative, it’s from insurance premiums paid because of the banking companies, and you will desire made for the money invested in All of us authorities loans, according to the FDIC. The bucks for everybody for the are, for the moment, coming from the FDIC’s Deposit Insurance policies Finance, that has said it will include the depositors to your establishment.

Which had been the brand new instant cause for dying for systemically and you may symbolically crucial bank regarding the technical community, however, to get at that time, a lot of whatever else had to happen very first. State and federal regulators should be on the lookout whenever banks deal with a lot of risk, intervening to safeguard depositors or other customers. But government, particularly the FDIC, don’t work forcefully, relying on suggestions characters unlike mandates to help you goad banks in order to do better. Just before their deviation, Johnson had pushed Nothing to give a lot more aggressively inside the Las Vegas’ roaring commercial real estate market. Property speculators was approaching neighborhood banks such Gold County to possess finance to construct the new subdivisions and strip centers you to appeared to springtime in the wilderness almost pre-molded. Absolutely nothing got instead exercised alerting, capping the quantity the lending company perform provide to shop for raw belongings.