Should i Refinance My personal Home Security Loan?

Youre going to be redirected that is not aside away from . Please note that Belco cannot offer or take responsibility for the things, characteristics, otherwise overall articles given with the third-group webpages. Belco cannot act as a real estate agent on 3rd party, and their privacy and you may defense formula may differ.

Present Postings

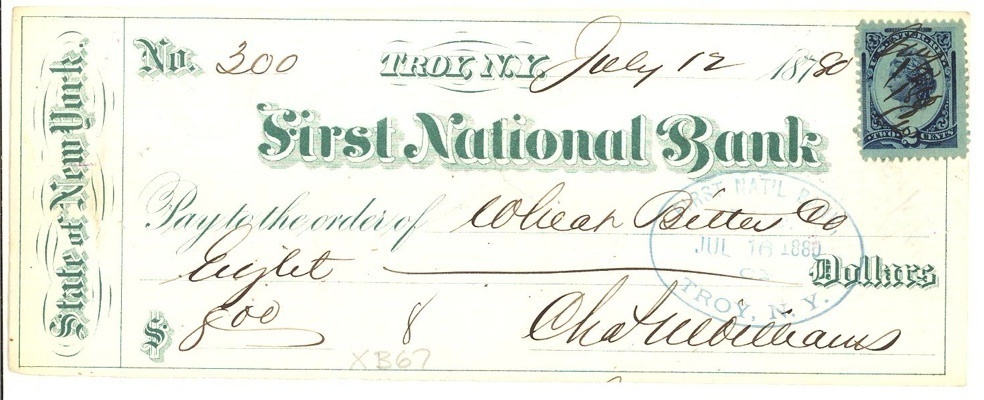

- How exactly to Endorse a choose Cellular Put

- ten Money Administration Tips to Alter your Money When you look at the 2024

- How exactly to Upload Currency that have Zelle Safely

- Try Money Markets Profile Safer?

- Advantages and disadvantages out of Certification Membership

Federally Seen Holidays

Ought i re-finance my personal home collateral mortgage? Of numerous homeowners question if the refinancing a preexisting house security mortgage otherwise credit line is a good idea. Why don’t we glance at the reason why you may want to re-finance your existing financing and the ways to go about carrying it out.

Double Dip: Do i need to Refinance My personal Family Security Mortgage?

Your home is your best financial support and many property owners leverage one worthy of with a mortgage otherwise personal line of credit. Changes in the property field along with your private financial situation you’ll have you questioning when it is possible-and you can wise-to help you re-finance your financing.

As to the reasons Refinance?

Whenever you are there’s commercially loans Lakeside zero maximum to the number of times you normally refinance a house guarantee mortgage, performing this boasts a range of will cost you. Very let’s look at a few examples where refinancing a house security financing otherwise line of credit could make feel.

Lock in Down Interest levels

If you find yourself rates are ascending again, you might still have the ability to secure a far greater speed or down money than just the modern household equity mortgage, especially if you re-finance for the same title, or you are entitled to far more collateral of your home since your took out of the brand spanking new financing.

Change to a predetermined Speed Financing

Home collateral lines of credit ( HELOCs ) offer a convenient way to get cash out of your home, but their variable interest levels can work facing you, especially if interest rates have increased. Refinancing the HELOC just like the a fixed-price home collateral loan normally secure a lowered repayment rates.

Obtain A whole lot more

Day delays for no that whenever you really need to obtain money, a house security financing has been the least expensive treatment for manage they. If you would like a lump sum payment to aid pay educational costs will set you back or even build a downpayment for the another house, after that doubling off that have a house equity financing re-finance is still the new best strategy to use.

Improve Terms and conditions

Do you need to pay less monthly otherwise faster over the long run? Refinancing your property security financing to own a longer term-say 30 years instead of 15-form you could provide money with other means today. For those who have extra money now available, refinancing to have a shorter period means you can easily spend reduced inside the notice and you can investment costs eventually.

Consolidate Obligations

Home loans are still good location to playground high-attention loans-and not just out-of HELOCs. Combining payments off credit cards or signature loans inside a great refinanced family security mortgage may save you money today along with tomorrow, even though your own refinanced rate is higher than your totally new mortgage.

Your took on a varying-rate HELOC with the best of objectives, but simple terminology otherwise unforeseen expenses have gotten the greater of you. Now you face suddenly highest charges as your financing resets so you’re able to a much higher price. Refinancing your debt today due to the fact a home guarantee mortgage might help your dodge one to round.

Avoid Balloon Repayments

Likewise, if unforeseen obligations form you face a beneficial balloon commission towards the good personal bank loan otherwise HELOC to take your repayments relative to your loan identity, upcoming refinancing you’ll render a less expensive way-out about a lot of time label. You could also save money by avoiding a substantial prepayment punishment for folks who repay a changeable-rate mortgage early!

Methods so you’re able to Re-finance a home loan

Refinancing a home loan otherwise household security personal line of credit is actually similar to making an application for their fresh financial. Generally speaking, you will:

Put your Residence’s Equity to get results

Put right, your house’s equity is an excellent financing having affordable capital. Within Belco, we offer our participants from inside the central Pennsylvania versatile payment terminology and aggressive pricing to assist financing renovations, debt consolidation, educational costs, and other essential needs.

Deja una respuesta