The procedure of Playing with Belongings due to the fact Deposit

Land-in-Lieu Investment to possess a cellular Family

Today we’re going to mention just how home buyers may use house since the brand new deposit on their mobile household, a choice referred to as Land-in-Lieu on the cellular home industry.

Over the last few articles i have gone over solutions to have home buyers who do not yet individual house and want to invest in each other its homes and house toward one financial (read more to your people options right here and here).

But for people that already own the residential property, the fresh land-in-lieu alternative can be very tempting because does away with you would like to produce a huge dollars downpayment.

The reason for a downpayment

Its pretty common knowledge that if you buy property, needed a down payment. Depending on a number of co-centered points (credit score, income, loan amount, etc.) a loan provider will establish the complete advance payment required.

It does typically slide ranging from 5% and you can ten% of the full household speed and additional property developments becoming rolled toward loan.

Advance payment ‘s the proof yours resource towards high get you will be making. It could be easy for people to ask for a loan having a earnings and you can credit rating when they did not have so you’re able to actually dedicate some of their unique money on the buy on their own.

But of the dependence on your own financial support, besides really does the bank enjoys something to clean out in the case of foreclosures, but the house-owner do too-this new thousands of dollars delivered when the house was purchased.

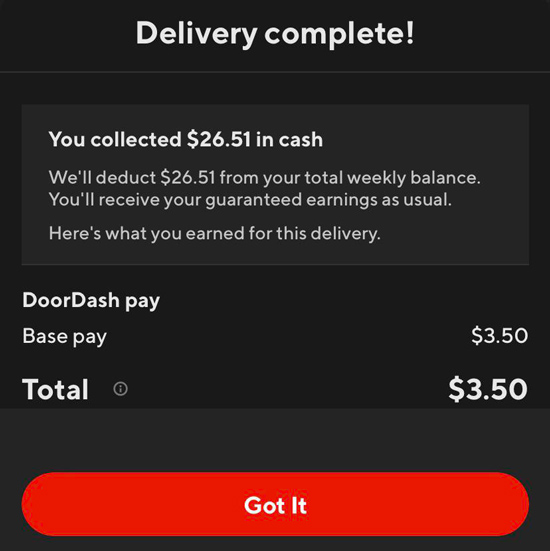

With home-in-lieu financial support, in lieu of your own personal financial support regarding loan being a funds lump sum, youre instead investing along with your homes.

Just like any mortgage, the process begins with a free of charge borrowing from the bank application. Their construction representative tend to direct you by this, assisting you to structure the program provide your own end up in lieu from a down-payment.

As approval returns, very often the list of most of the paperwork needed seriously to go-ahead toward closing dining table. The bank tend to require activities for instance the action so you’re able to the brand new residential property to prove control, a recent income tax document that shows this new tax appraised well worth, paystubs, W-2’s, or other financial approved models and waivers.

After these documents have been processed and you may cleared because of the lender, it could be time for you to acquisition both the appraisal towards the house and you can what’s named an effective name lookup.

A subject business commonly research the property and you may homeowners to help you verify there are no an excellent liens or decisions into home to possess delinquent fees. In the event that unpaid fees are found, they must be paid during the closure that have bucks off brand new debtor.

Whether your debtor do not want to pay off new the taxes, the latest property may not be practical while the a down payment one expanded and could cause the domestic buyer to get rid of brand new recognition to their mortgage.

Normally, when a land-manager features a common term, its name lookup can show outstanding taxation which might be another person’s. In such instances, an excellent not the same person affidavit try closed plus the user’s installment loans Missouri label would be cleaned out-of those liens.

The Downside out of Belongings-in-Lieu

Something you should remember when the deciding to provide your belongings because the an advance payment when buying a mobile domestic, is the fact in place of inside a beneficial chattel loan (financing our home simply), the financial institution usually, in case of foreclosures, very own the residential property and you will household to each other.

Because home ‘s the personal funding, otherwise guarantee, utilized in procuring the mortgage, you will need to remember that brand new lien would-be toward the house and you can property to one another throughout the mortgage.

This one can be very very theraputic for home buyers just who cannot create the currency needed for the deposit on buy of their mobile domestic even so they should also see the possible danger of shedding not just their property, nevertheless complete capital of its home too.

Another type of possible downside is having your land appraise for under precisely what the lender means to own a downpayment. In this instance you would have to create the difference in cash and you may could have each other your own home and cash invested into the brand new mobile mortgage.

Into flipside, however, land normally well worth more the bottom 5% criteria and will let the family client a higher financing approval, permitting them to finance pricey homes developments (tools, porches, skirting) toward loan, they can has otherwise been incapable of manage.

Just like any financing, you can find positives and negatives becoming considered, and it’s crucial that you comprehend the full range of the commitment you will be making while the a house customer.

An experienced casing associate along with your upcoming achievement as the a house-owner planned should be able to make it easier to restrict your options that assist your follow the financing which makes the essential small and you may long-title economic experience for you personally.

Deja una respuesta